Branded vehicle titles indicate legal issues like loans, liens, or judgments, impacting ownership transferability. Car title loans for these vehicles, secured by equity, offer quick funding (1-4 weeks) to those with less-than-perfect credit but require clear title, proof of income, and valid ID. Disqualifiers include outstanding debt, liens, severe damage, or mechanical issues; lenders carefully assess risk before approval.

Exploring car title loans for branded titles? Understand the nuances first. A branded title vehicle, while seemingly valuable, can carry hidden complexities. This article delves into the factors that disqualify you from car title loans on branded vehicles. Learn about branded titles, eligibility criteria, and the common pitfalls to avoid. By understanding these aspects, you’ll make informed decisions regarding your financial needs.

- Understanding Branded Titles: Definitions and Implications

- Loan Eligibility Criteria for Branded Vehicles

- Common Disqualifiers: Why Car Title Loans Are Denied

Understanding Branded Titles: Definitions and Implications

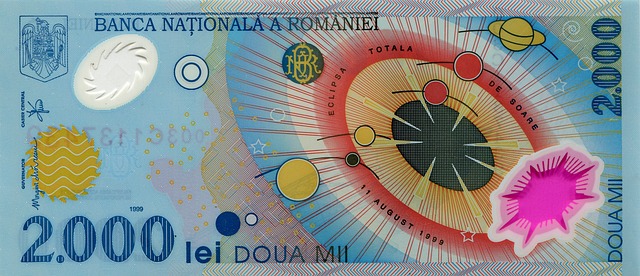

Branded titles, also known as encumbered or non-standard titles, refer to vehicles with legal issues that impact their ownership and transferability. These can include outstanding loans, liens, or judgments against the vehicle. When a car has a branded title, it means the original owner retains some form of financial claim over the asset, which can complicate the process for prospective buyers or lenders.

For individuals seeking a car title loan on a branded title vehicle, understanding these implications is crucial. While traditional loans may require proving vehicle ownership through a clear title, branded titles present additional hurdles. Lenders typically assess the value of the vehicle’s equity, considering both the market value and any outstanding obligations tied to the title. This process ensures that they provide quick funding while mitigating risk in cases where the borrower defaults on their loan payments.

Loan Eligibility Criteria for Branded Vehicles

When considering a car title loan for branded title vehicles, understanding the eligibility criteria is essential. Unlike traditional loans that often require impeccable credit scores and extensive financial histories, car title loans are secured by the vehicle’s value, making them accessible to a broader range of borrowers. This includes individuals with less-than-perfect credit or no credit history at all. Lenders will evaluate the overall condition and market value of the branded vehicle to determine loan eligibility.

In the case of San Antonio Loans, for instance, potential borrowers can leverage their branded title vehicles as collateral to secure emergency funds when facing unexpected expenses. The process typically involves providing proof of ownership, vehicle documentation, and a clear title. While specific requirements may vary between lenders, having a stable income and a valid driver’s license are common prerequisites. This financial solution offers a quick way to access immediate funds for various purposes, such as paying bills, covering medical costs, or dealing with unexpected car repairs.

Common Disqualifiers: Why Car Title Loans Are Denied

Car title loans for branded title vehicles can be a tempting option for those needing quick funding. However, understanding common disqualifiers is essential to avoid rejection. Lenders carefully evaluate each application, considering various factors that could impede their ability to repay the loan. One significant reason for denial is outstanding debt on the vehicle—if you already owe money on your car through a lease or previous loan, it might hinder your eligibility.

Another common disqualifier relates to the condition of the branded title. Lenders prefer vehicles with clear and unencumbered titles. If there are any liens, judgments, or outstanding taxes associated with the vehicle, these can be showstoppers. Additionally, severe damage or mechanical issues could impact a borrower’s ability to use the car as collateral, leading to loan denial. While car title loans offer quick funding, they come with strict criteria, and lenders must assess each risk factor before approving an application for debt consolidation or any other purpose.

Car title loans for branded titles can be a useful financial option, but understanding the disqualifiers is key. Several factors, such as extensive vehicle modifications, outstanding liens, or recent brand recalls, can hinder eligibility. By being aware of these common disqualifiers, potential borrowers can prepare their applications and explore alternative financing solutions accordingly.